June Inflation Print Reveals Tariff Inflation

Trump’s Tariff War has already shown up in the data and it’s only going to get worse as the months wear on.

By Max from UNFTR

WATCH THE VIDEO REPORT BASED ON THIS ARTICLE ABOVE…

The June CPI print is out and the data reveal that prices on consumer items across the board are going up.

“Shocking,” said no one anywhere, ever.

Of course, these are just the headline figures. Beneath the surface trouble is brewing for the Trump administration and the American economy.

Inflation by the Numbers

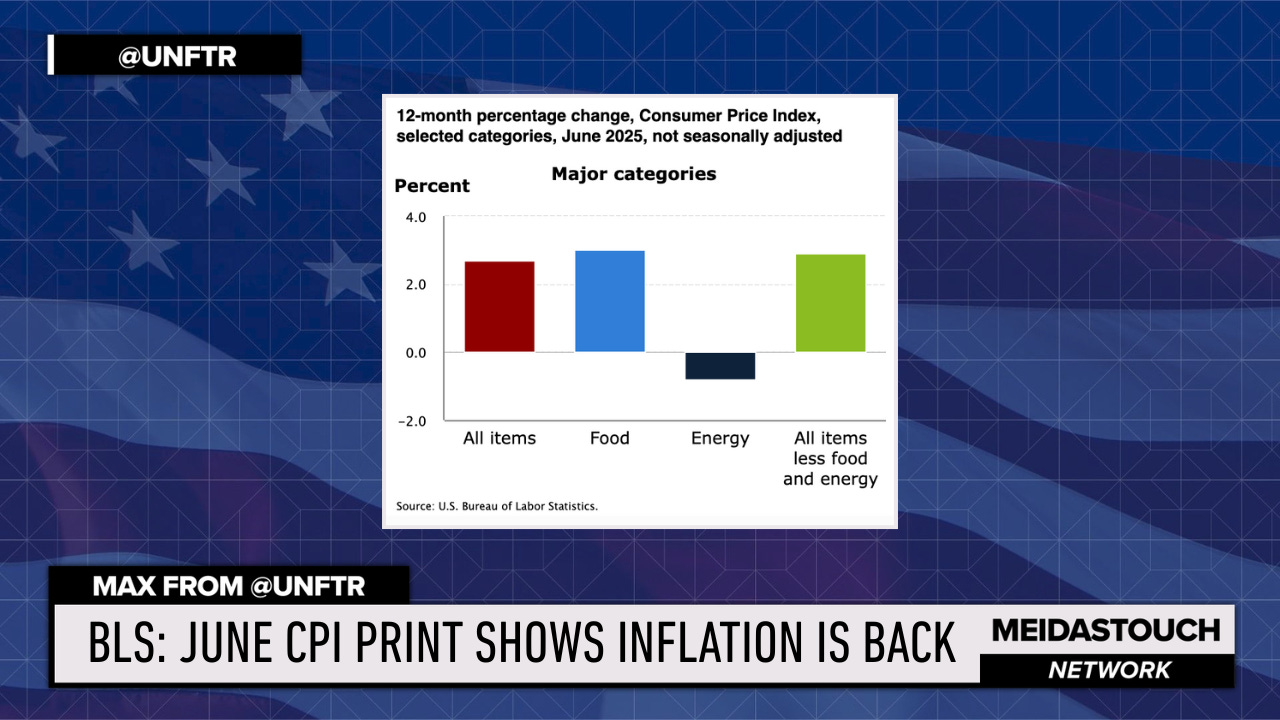

According to the BLS, The “all items index” rose 2.7 percent for the 12 months ending June, after rising 2.4 percent over the 12 months ending May. The “all items less food and energy index” rose 2.9 percent over the last 12 months.

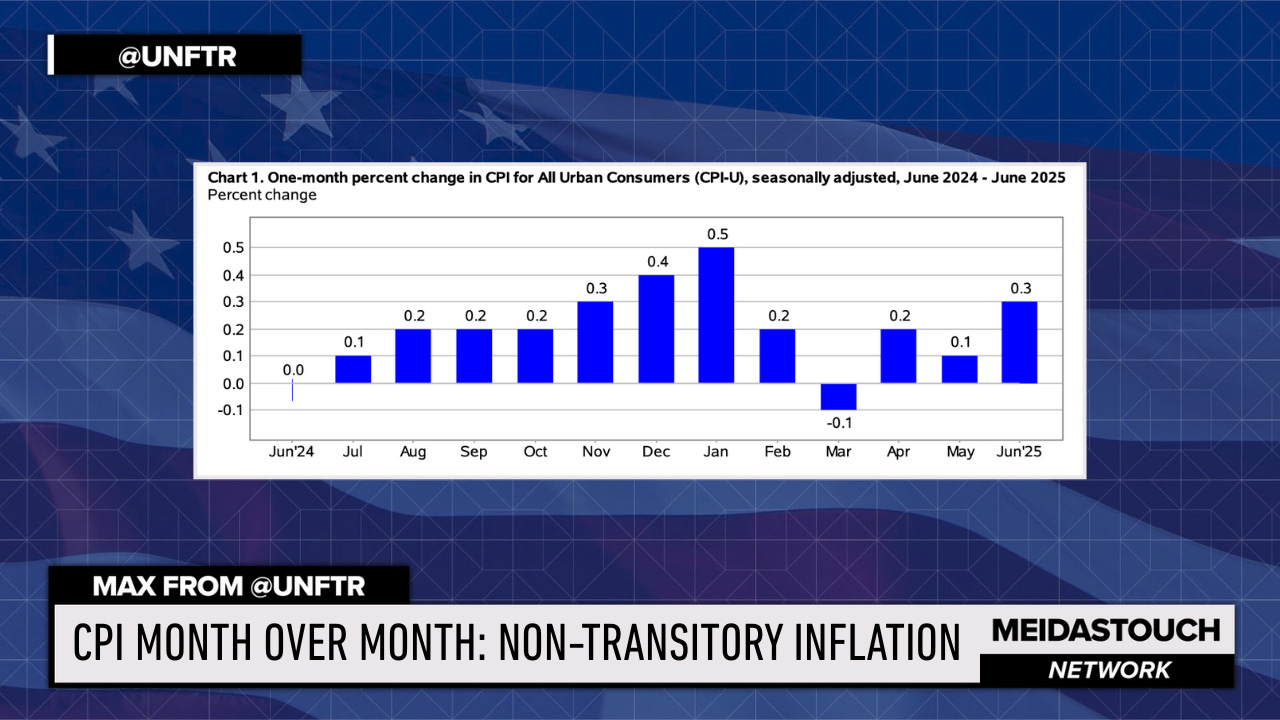

Before we break things down further, it’s important to view it as a trend so let’s look at the data over time.

What we’re seeing here is that inflation is not transitory as the administration had hoped. You can see where the sense of optimism was in the early part of 2025 when inflation decelerated in February and actually fell in March, but then it reared its head again in April, slightly again in May and now you can see that it took off in June.

A few points before we look at the individual components, which tell the only real story that matters to U.S. consumers. We’ve said all along that inflation would start to show up in the data in a meaningful way beginning in June because companies would have started to turn over the cheaper inventory they stockpiled ahead of the tariff war. Upon replenishing inventories, core inputs would start to push the numbers higher.

We’re not the only ones who have been saying this, by the way. It’s one of the primary reasons the FOMC has been reluctant to move on interest rates. But the real damage has yet to be seen and you’ll probably see it bleed out even more in the months ahead.

Caveat One: The first is that energy prices are a drag on these figures, so it’s always important to exclude them. When a conflict breaks out or heightens anywhere on the planet, speculators push energy prices higher and it can have an immediate impact. The flip side of that is also true in that when geopolitical forces are calmer, you get a sense of what energy really looks like because it correlates more closely to supply and demand.

Caveat Two: So the other caveat is an economic slowdown will have a muted effect on inflation going forward. As we continue to fall further into the Trump Recession and global demand cools off it has a double impact on inflation, or at least it should. Energy prices typically cool quickly in a recession because our reserves and production are solid and the gap widens between supply and demand. But it also means that in sensitive segments of the economy like new automobiles, RVs, certain durable items, producers start to cut prices to woo consumers back.

The problem for the administration is that the tariffs are being actualized in the inflation data. Hard to imagine considering we have the world’s best deal maker personally writing these deals.

Paging Jerome Powell

These forces are already pulling back on certain segments, as we’ll see in a moment. Which means the tariffs are already pushing prices higher. This is the dreaded stagflationary environment that everyone wanted to avoid, including Trump. It’s why he’s so adamant about pushing Powell to lower interest rates to spark consumer refinancing and corporate debt restructuring and hiring. Lowering rates would give an artificial boost to the economy for a short period of time.

However, the Fed’s dual mandate is to manage both inflation and unemployment. So if there’s inflation, conventional theory calls for high interest rates to suppress it. When there’s high unemployment they lower rates to spur investment and hiring. Right now inflation is going up and so is unemployment and that’s why the Fed is stuck between a rock and a hard place, on paper at least.

But it’s not stopping the administration from hammering Powell over rates, which shows both a fundamental misunderstanding of the situation and a bit of desperation.

The Trump brain trust of Peter Navarro, Scott Bessent, Howard Lutnick and Stephen Miran believe that the tariff deals will spur manufacturing and growth, thereby negating any negative impacts to the economy. First off, these aren’t “deals.” A deal suggests mutual agreement. These are shakedowns. One-sided tariff demands will bring money into the federal coffers in the short-term, but in the long run the world will just re-order the supply chain to reduce their dependence on our dwindling manufacturing sector. It’s just math.

Given the courts seem to be granting the administration complete authority to hire and fire at will, eliminate federal agencies and potentially revoke birthright citizenship, it’s hard to imagine they won’t just fire Powell before his term ends and replace him with Scott Bessent. (That’s the plan, by the way, so stay tuned.)

Drill Down

Let’s dig into the segmentation to show why these figures are far more devastating for the consumer than the corporate media is telling you by just parroting the headline numbers. Because saying that inflation went up .3% doesn’t sound as terrible as telling you that it technically tripled month over month and if you carry it out over the year we’re back into 3 to 4% inflation territory in a best case scenario.

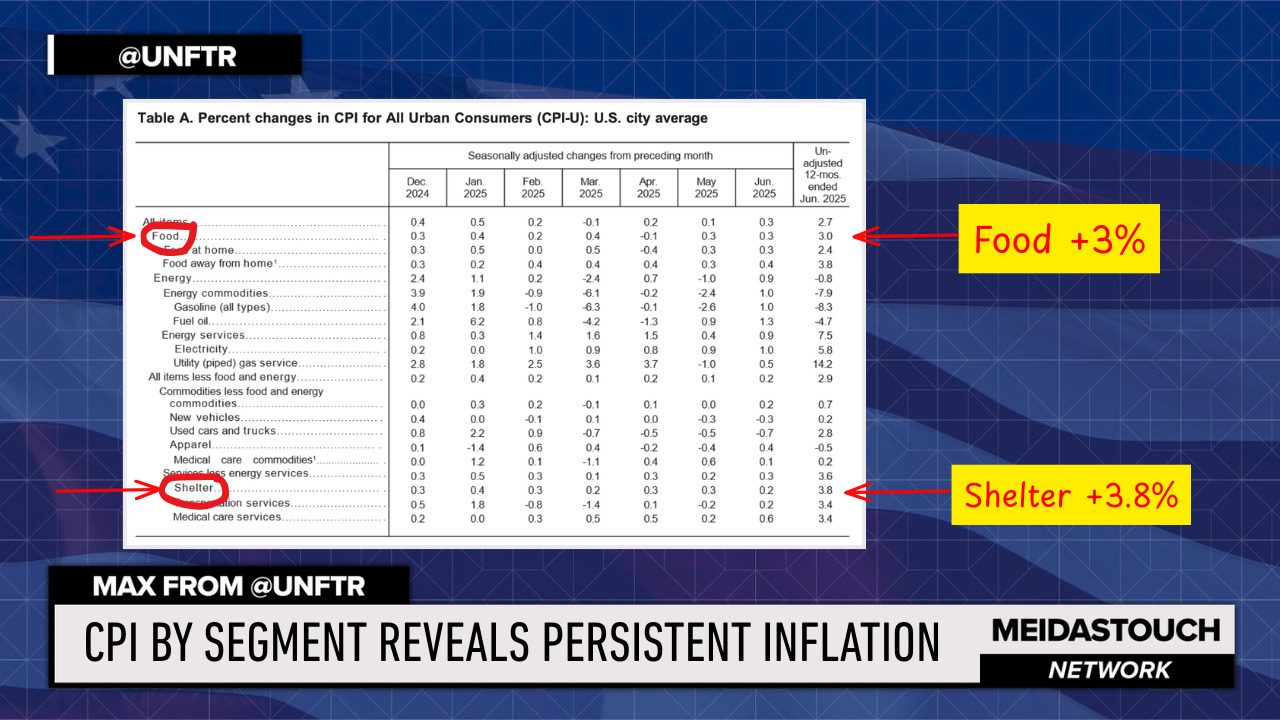

There’s inflation that hits periodically and then there’s unavoidable inflation that hits everyone. Not everyone is impacted by gas prices. Not everyone is shopping for clothes all the time. Not everyone is looking for a new or used car and not everyone has to get a prescription. At some point, these may all come into play, but the point is that these are episodic in our lives.

The two unavoidable and universal inputs to every household budget, however, are food and shelter. And this is where the “it’s not that bad” narrative begins to break down.

As you can see above, food increased 3% year over year in the June print and shelter increased 3.8%.

Point being, not all inflation is equal. Now here’s where the narrative and spin from the administration and mainstream media starts to fall apart.

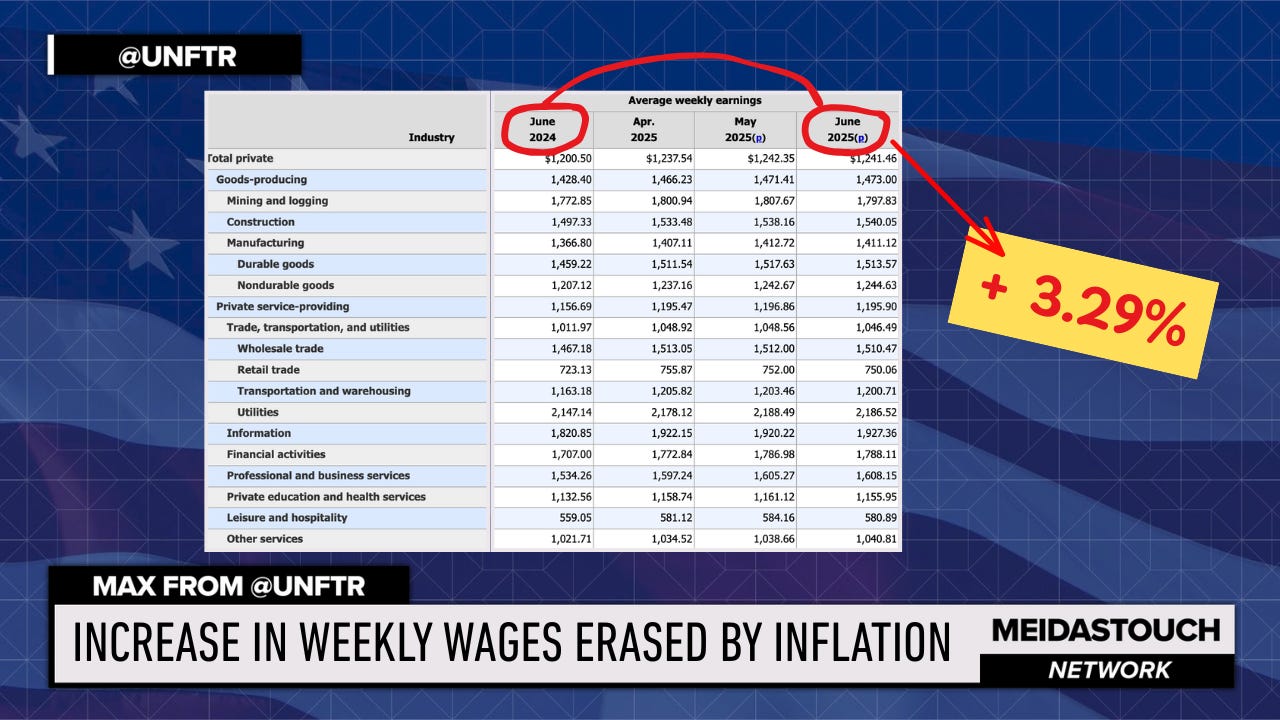

Preliminary June data on weekly wages show the increase in the average weekly earnings between June 2024 and June 2025 is approximately 3.29%. Set against core inflation year over year for the same period of 2.7% and you get a feel for why the media and administration are so tepid in their responses to inflation data.

Essentially, the consensus view is that as long as wages are increasing more than inflation, everything is okay for the moment. And they reflect this in what they call “real” earnings releases and, in fact, here’s what they said about that.

“From June 2024 to June 2025, real average hourly earnings increased 1.0 percent, seasonally adjusted. The change in real average hourly earnings combined with a 0.3-percent decrease in the average workweek resulted in a 0.7-percent increase in real average weekly earnings over this period.”

Two important takeaways here. First is that it’s not a fair comparison to benchmark total wage growth against total inflation. They’re setting wages against inflation to arrive at “real” wage growth of .7 percent when we know that the inflation numbers are being pulled down by the periodic inflation figures and not the persistent ones like shelter and housing.

Food is up 3% and shelter is up 3.8%. That’s the real benchmark, in which case it demonstrates clearly how the consumer is totally under water. You’re not crazy, your money isn’t going as far as it used to and that’s why people are cutting back on spending already.

The second point is that the wage figures are drawing from employment figures, obviously. And we know that piece of the pie is shrinking from prior work we’ve done here on MeidasTouch.

The great squeeze is on.

It’s Not You… It’s Them

These breakdowns are important because these figures are what they use to rationalize their policies. Hopefully it gives you the information and power to call B.S. It also helps assuage the psychological pain of economic precarity and that’s going to be important in the months ahead as we fall deeper into the Trump Recession.

There’s a psychological trauma that comes with not being able to pay your bills. When recessions (like the one we’re in right now) happen, people’s first instinct is to go on like everything is fine. And if you see everyone else pretending things are fine, it actually induces a higher amount of personal stress as though you must be doing something wrong.

This economy has been terrible for a long time for the majority of Americans. But what’s reflected back to you through the media—with these charts and graphs and figures—is that everything is actually okay.

As we’ve said before, it’s why the Democrats lost. They didn’t acknowledge the pain. It’s why Zohran shocked the world in New York City. Because he acknowledged the pain. It’s important that Democratic voters are all singing from the same hymnal. Remember, there’s more of us. But it won’t feel like it if we’re all saying and thinking different things because someone else is manufacturing a false narrative.

So, no. You’re not the only one suffering right now. Inflation is real. The labor market is shrinking. Real wages are declining for the vast majority of Americans and now that pain is being shared with our Canadian brothers and sisters and every other country we have decided to put in our crosshairs for no apparent reason.

Max is a contributor to the MeidasTouch Network and Publisher of UNFTR Media. Watch his video report on this topic by clicking here or by watching the video at the top of this article.

For deeper dives into economic and socioeconomic stories, visit UNFTR.com or @UNFTR on YouTube. Make sure to sign up for the FREE weekly UNFTR newsletter here.

Resources

BLS: June CPI

BLS: Real Earnings

Census: Inventories

I hope rising prices are what finally gets his devotees to turn against him. That and the burying of the Epstein files. They don’t seem to be disturbed by anything else that he does.

America is actually closer to the Trump Depression. Recession would actually be the best case scenario and we know the corpos and Dementia Don are too incompetent to fix it. While the billionaire parasites actually want a Recession because their goal is to turn America into Muscovy. (Ukrainian word for the Ruzztards). While they will hurt with a Depression.